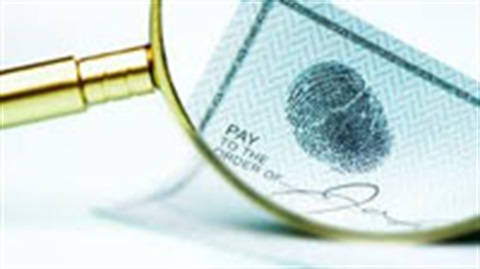

Fake Check Scams

Fake Check Scams

There are many variations of the fake check scam. It could start with someone offering to pay you for a service, or purchase an item you've advertised for sale. Other offers promise an "advance" on a sweepstakes you've supposedly won, or pay the first installment on the millions that you'll receive for agreeing to have money in a foreign country transferred to your bank account for safekeeping. Scammers may claim to live far away or even in a foreign country, making it difficult to send you money directly.

In nearly all instances of fake check scams, the scammer will ask you to send money back to them in some way, shape or form. They will send you a check for goods or services for more than the requested amount, and will tell you to go forward and deposit their check and wire them the additional money. In other scams, they will tell you to wire money for taxes, processing, legal fees, shipping, or any number of "other" expenses that you must pay before receiving your money or reward.

Be Aware Of…

Fraudulent checks will clear quickly.

Under federal law (Expedited Funds Availability Act), banks have to make the funds you deposit available quickly - usually within one to five days, depending on the type of check. Although the money is available for you to withdraw from, the bank may discover a forgery a few weeks down the road and the check may bounce.

Your deposits are your responsibility.

If you have deposited a check that then bounces, the bank will withdraw the original dollar amount credited to your account. If your account doesn't have enough money to cover the deduction, the bank may sue you to recover the funds.

There is no legitimate reason for someone who is giving you money to ask you to wire money back.

Always insist that the check be in the exact amount, or deal in cash. Emphasize that you prefer a check from a local bank or a national bank with a branch in your area.

Additional Resources.

The National Consumers League recently launched an educational website, FakeChecks.org.